Financial advisors specialize in a range of financial services. These include retirement planning, charitable giving, and even tax planning. So clients can make an informed decision about which firm to choose and what services they offer. There will be a wide range of services offered by different firms. It is important that you find the one that offers the best services and has high levels of experience.

Fee-only financial advisors

You can get financial advice in Charlotte for a nominal fee. They are experts in a wide range of areas including tax planning, estate planning, investment management and tax planning. Some of them also offer retirement and college planning services. All are registered investment advisors. To learn more about their services, contact them.

Fee-Only financial advisers might be paid an hourly fee, a retainer, or a percentage from your assets. A fee-only advisor will protect you from conflicts of interest that can compromise your financial health. Fee-only advisors have a fiduciary obligation to give advice that is in your best interests.

Financial advisors can charge a flat fee (usually $1,000) to help you create a comprehensive plan. Others earn their fees from commissions on investments you make through them. Your assets are usually between 3%-6%, and mutual fund sales loads can range from 3% to 66%.

Tax planning

When it comes to tax planning, Charlotte, NC financial advisors can be a valuable resource. Charlotte financial advisors offer a range of services, including advisory and investment management as well as 401(k), plan planning. These firms often offer tax planning advice. Some of these firms are independent, while others have Charlotte headquarters and can serve clients throughout the United States.

Greenway Wealth Advisors is a Charlotte-based firm that offers a wide range of services, including estate planning, retirement planning, and tax efficiency. The firm's founder, Nick Foy, has been in the financial management business for more than a decade. He is also a member of National Association of Insurance Financial Advisors and Investments and Wealth Institute.

Byron Financial, a small firm that specializes only in high-net worth clients, is Byron Financial. They also work with pension plans, profit-sharing plans, and charitable organizations. Fees for Byron Financial are based on the client's assets under management, and there's no minimum account size.

Retirement planning

Financial advisors Charlotte, NC can provide tailored financial planning services to their customers. They can also assist clients in creating investment strategies and estate plans. They provide regular reviews as well as tax efficiency and work on tax efficiency. Many clients have found that financial advisors in Charlotte, NC are highly reliable and provide valuable financial advice.

While financial advisors may not be able always to help with complicated retirement planning details, Charlotte's financial advisors can. However, a financial advisor can help you develop a comprehensive plan that will provide you with a comfortable retirement. Financial planners in Charlotte, NC can help you plan and manage your assets to ensure they will remain safe and grow in value.

Financial advisors are available in Charlotte who specialize on retirement planning. This professional may be a specialist or they can work with clients all over the region. A fee-only financial advisor is also available. This type of financial advisor does not receive commissions and is legally obligated to put your interests first. They are independent of any insurance company, brokerage firm, or bank.

FAQ

How do I choose the right consultant?

There are three major factors you should consider:

-

Experience - How many years of experience is this consultant? Is she a beginner, intermediate, advanced, expert, or something else? Does her resume reflect the knowledge and skills she has?

-

Education - What did this person study in school? Did he/she pursue any relevant courses once he/she graduated? Is there evidence that he/she learned from the writing style?

-

Personality – Do we like this person/person? Would we prefer him/her working for us?

-

These questions will help us determine if the consultant is right to meet our needs. If the answers are not clear, it may be worthwhile to interview the candidate in person to get more information about them.

Are you a consultant?

Consulting is not only an entry-level profession for those looking to make fast money, but it's also an excellent way to acquire valuable skills that you can apply throughout your career.

There are many opportunities for consulting, including project management, strategy, training and leadership. You might find yourself working on projects ranging from small start-ups to large-scale international corporations.

Consulting gives you the chance to grow and develop your skills. This could include learning how to manage teams, write proposals, manage budgets and analyze data.

How does consulting differ from freelancing?

Freelancers work as independent contractors and offer their services without the assistance of an agency or company. Hourly rates are usually charged based on the time they spend working on a client’s project. Consultants often work for companies or agencies that employ them. Their salaries are usually paid monthly or annually.

Because they set their own hours and prices, freelancers are often more flexible than consultants. Consultants have better benefits, like health insurance, vacation time, sick leave, retirement plans and etc.

How much are consultants paid?

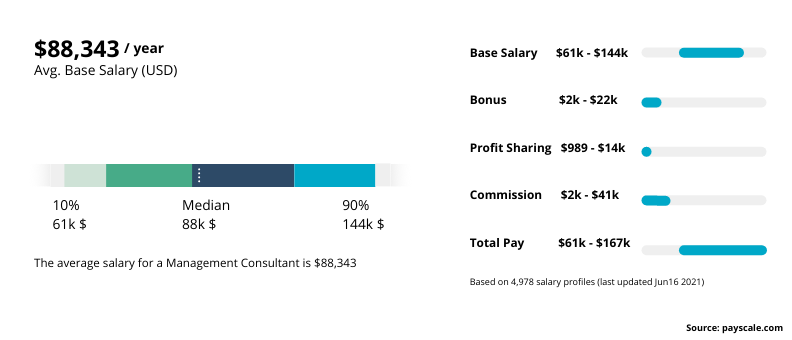

While some consultants may make over $100k per annum, most consultants earn between $25k and $50k. An average consultant salary is $39,000 This includes hourly as well as salaried consultants.

Salary depends upon experience, location, industry and type of contract (contractor/employee). It can also depend on whether the consultant has their own office or works remotely.

Do I need to pay tax on consulting income?

Yes, you will need to pay tax on your consultancy profits. It depends on how much income you make per year.

You can also claim expenses if you are self-employed. This includes rent, childcare, food, and transportation.

But, interest payments on loans, vehicle and equipment depreciation will not be allowed to be deducted.

You can only claim back 25% of your expenses if you earn less than PS10,000 a year.

However, you might still have to pay tax if your earnings are higher than the threshold. This depends on whether you are an employee or contractor.

Employees are generally taxed through PAYE (pay as you earn) and contractors through VAT.

Statistics

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

External Links

How To

How to start a consulting company and what should I do first?

You can make a lot of money by setting up a consulting business. No prior business experience is required. You can start your own consulting firm by building a website. You can use social media platforms like Facebook, Twitter, LinkedIn and Instagram to promote your services.

You can create a marketing strategy that includes these things with these tools

-

Create content (blogs).

-

Establishing relationships (contacts).

-

Generating leads, also known as lead generation forms

-

Selling products through ecommerce websites

Once you have created your marketing strategy you will need to find clients that will pay for it. Some prefer to connect with people through networking events. Others prefer to use online resources like Craigslist and Kijiji. It's up to you to make the decision.

Once you've found new clients, you'll want to discuss terms and payment options. These could be hourly fees, retainer arrangements, flat-fee contracts, or other types of fees. It is important to clearly communicate with clients before you accept them as clients.

An hourly agreement is the most common contract for a consulting service. In this case, you agree to provide certain services at a fixed rate each month or week. You may be eligible to negotiate a discount, depending on the service that you offer. It is important to understand the terms of any contract you sign before you sign it.

Next, create invoices and then send them to clients. Invoicing can seem simple until you try it. There are many ways that you can invoice your clients depending on what your preferences are. Some prefer to send their invoices directly by email, while others prefer to print and mail hard copies. Whatever method you choose, make sure it works for you!

After you've finished creating invoices, you'll want to collect payments. Most people prefer PayPal because it is easy to use and offers various payment options. You can also use Square Cash, Square Cash (Google Wallet), Square Cash, Square Cash, Apple Pay and Venmo as payment processors.

Once you are ready to start collecting payments, it is time to open bank accounts. You can track income and expenses separately by having separate savings and checking accounts. When paying bills, it is also beneficial to set up automatic transfer into your bank account.

When you start a consultancy business, it may seem overwhelming, but once you learn how to do it correctly, it becomes second nature. This blog post will provide more information about starting your own consultancy business.

You can make extra money by starting a consulting company without worrying about staff. Consultants can work remotely so they don't have the hassle of dealing with office politics and long working hours. Since you are not tied down by regular working hours, you have more flexibility than a traditional employee.